The B2B2C healthtech conundrum: How do you acquire patients?

The billion dollar question for healthtech startups selling B2B2C: How do you get a member to enroll?

A startup selling B2B2C, or business-to-business-to-consumer, partners with another organization like a health plan or employer to provide their program to the end consumer. Once the startup’s sales team has signed a contract with the partner, the partner will pass on a list of patients or “covered lives,” and the startup will need to figure out how to reach and acquire those patients into their program. This is the job of an enrollment marketer. Other common keywords I’ve seen in titles include “patient acquisition,” “member acquisition,” or “outreach executive.”

Why has the B2B2C model become so popular in care delivery?

Once upon a time, direct-to-consumer, or B2C, was all the rage. The first care delivery startups like Ro, hims&hers, and Noom were shiny marketing front doors that relied on relatively low spend via Facebook and Instagram to reach consumers… all the way to unicorn status. As a flood of startups caught on to this playbook, those digital marketing channels became saturated, and startups faced high and unsustainable CACs.

That’s when startups shifted their focus on selling to other healthcare organizations, as a way to acquire members at lower costs and position themselves for value-based arrangements. In 2017, one-third of digital health startups who raised sold B2B2C. My bet is that % is even higher now. B2B2C has become the default go-to-market motion; so much so, that I know VCs who only seed startups who already have an enterprise partner lined up, or who exclusively back seasoned execs with 20+ years within health plans or employers.

The fallacy I’ve seen some VCs and founders fall into is that they’re obsessed with getting that enterprise contract over the line, but celebrate too soon. They miss that even B2B2C startups are ultimately consumer startups.

Empowering a consumer to need and want the program, and convincing them to get onboard — aka patient acquisition — is the North Star metric for a startup: Firstly, it’s how you get paid and how you optimize your unit economics to acquire members at affordable rates. Secondly, it’s how you drive clinical outcomes, because you need to enroll a member to treat them.

For marketers, growth leads, and execs in healthcare selling B2B2C (or considering doing so), I’ve consolidated foundational guidance from experts who’ve pioneered the B2B2C playbook. Within this post, I’ll cover:

- Common sales channels: Employers vs. health plans

- Setting up for success during sales

- Segmenting and prioritizing your population

- Hyperpersonalizing your content

- Determining the optimal marketing channels

- Piecing together a scalable tech stack

- TL DR; There is no silver bullet

Common sales channels: Employers vs. health plans

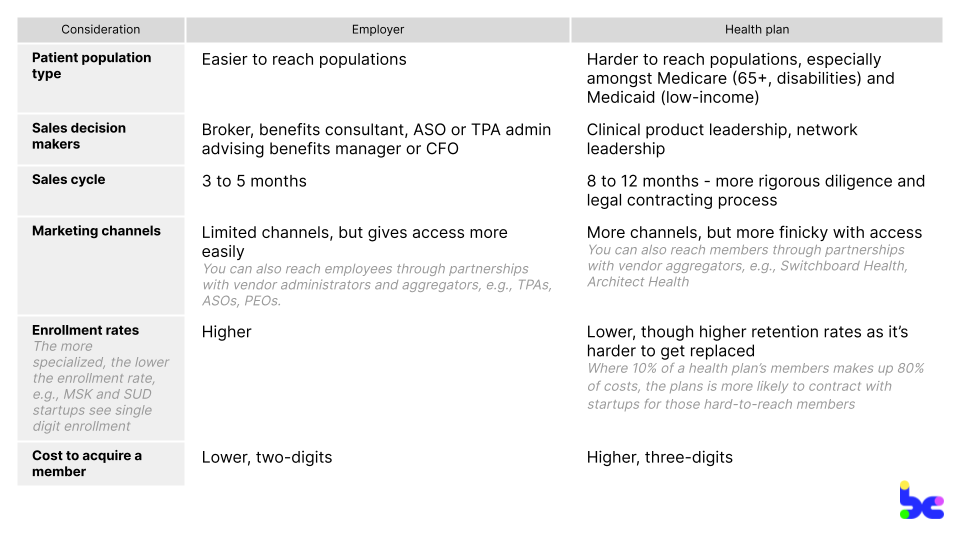

Health plans and employers are the most common B2B2C prospects because they’re the ones financing 80%+ of our healthcare through public and private insurance. In the likely case that you’re selling to both, set up separate teams and P&Ls to manage each sales channel, given they have wildly different stakeholders, sales cycles, and patient populations.

Some generalized differences:

Setting up for success during sales

Enrollment marketing starts upstream during sales, with a contract that aligns incentives for highest ROI between you and your partner. With your internal champion and financial decision maker, make sure that your sales team can carve out a statement of work (SOW) that explicitly includes agreements on:

Expected enrollment values

Control expectations on the partner side by outlining a range of expected enrollment values based on the amount of data and marketing the partner is willing to put in.

Data sharing

Very often health plans are super protective about their claims data and preauthorization data, not wanting startups to compete with their internal initiatives. With that warning in mind, try to bake data sharing agreements into the contract to get a 360 patient view, so you can measure and track program outcomes.

Co-marketing opportunities

Partners are risk averse in sending outreach messages on your behalf, given the myriad of vendors they may contract with. Agree on the stakeholders, approval process for outbound marketing, outreach channels, and cadence of outreach activities you have access to. Some example items you may want to include:

- Having your program listed on partner’s marketing sites and benefits guides

- Making sure partners’ member-facing teams can refer and answer questions to your program, by giving them guidance and scripts for FAQs

- Creating simple plug-and-play assets for the partner to deploy themselves in the style of their own brand

- Including the number of marketing touchpoints sent by the partner per month

Segmenting and prioritizing your population

Every startup will have a different model in which you segment and prioritize your covered lives by, using a myriad of factors like medical risk and likelihood to respond to marketing channels. A Spanish-speaking 62-year old employee in rural Louisiana is going to respond to messaging very differently than a 30-year old Mandarin-speaking mother living in New York City. If you’re a virtual musculoskeletal (MSK) provider, you’d prioritize the former; if you’re a virtual doula benefit, you’d target the latter.

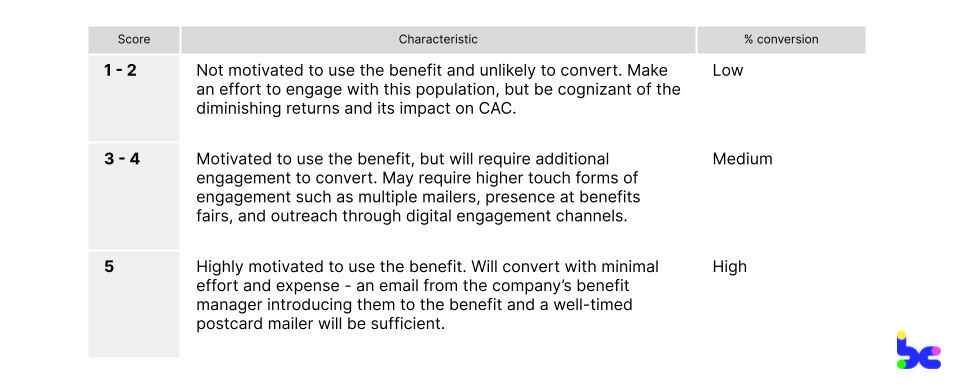

As a case study, let’s look at Company A, a chronic condition management company, to illustrate what segmenting could look like. (This case study is based on how one of the B2B2C pioneers set up enrollment marketing.)

When Company A receives the list of potential members from an employer, their data team works to segment the list and assign scores from 1 to 5 based on how likely the individual is to convert. Scores are calculated based on employer-provided information like claims data and benefit utilization. To align incentives, Company A makes contractual enrollment guarantees based on the data supplied — the more thorough the data, the higher % enrollment an employer could expect.

As more startups enter risk-based contracts, you’re also building sophisticated predictive analytics models in-house to find the highest risk members using demographic data, claims data, and even preauthorization data. Startups are even commercializing their specialty-specific models.

Hyperpersonalizing your content

Consumers are demanding more personalized experiences and that applies to healthcare content, too. Messaging that is culturally-competent and demographic-specific is critical to driving enrollment rates, especially for health plans where you may be working with a narrow subset of members; usually, the ones who are most at-risk and expensive.

Riffing off the previous profile of the 30-year old Mandarin-speaking mother living in New York City: In Chinese culture, mothers often have a 月嫂 period, where post-partum they hire a “confinement nanny” to provide mental and physical support at home for a month. To target that mother, you could use this cultural knowledge in a marketing email to draw parallels to the doula benefit you’re offering through their health plan, translated in Chinese. You could even put up a billboard in Chinatown.

In fact, I saw a primary care group serving Asian communities in NYC do just this:

Other tips here:

- Be clinically authoritative. Have messaging that speaks to the clinical efficacy of your program. Big plus points if the deliverer of the messaging is your Chief Medical Officer or clinical leader.

- Create the surround sound effect. Try a combination of messages and channels, and have them deliver at the same time so they work synergistically to capture a patient’s attention.

- Have your campaign hit on different themes. Always start a campaign by focusing on your company’s value proposition. You can also utilize season-specific touchpoints like holidays. And by the third month, you can offer incentive-based messaging like a free Amazon gift card to the last holdouts.

- Know when to move on. If a member is not responding to incentives, it’s highly unlikely for them to enroll with you. Focus your resources on members with a higher probability to enroll.

Determining the optimal marketing channels

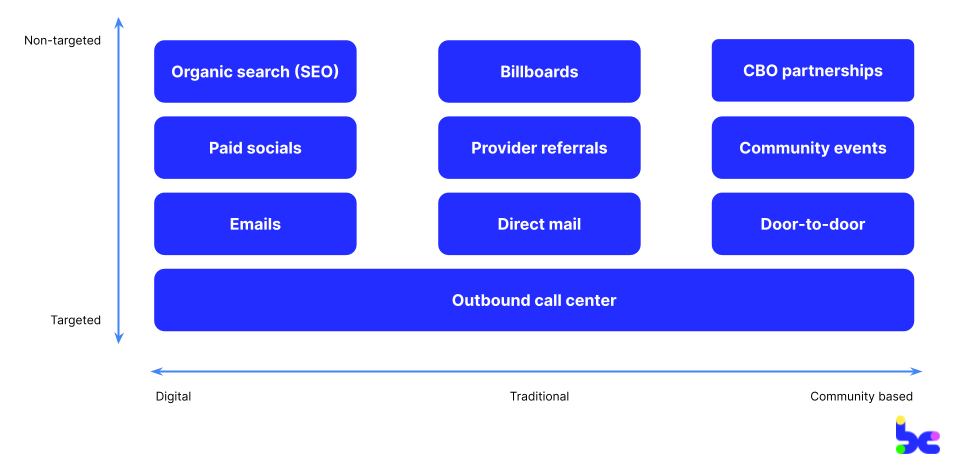

When it comes to marketing channels, I’ve organized them into two spectrums as illustrated in the diagram below:

On the x-axis, channels can span from digitally native (often better for employers who may live in their inbox) to community-based (often needed for hard-to-reach, underserved communities like low-income Medicaid or rural members). On the y-axis, channels span from targeted to non-targeted. Targeted will always be ideal, but is dependent on the amount of data on and responsiveness of members.

While not collectively exhaustive or mutually exclusive, I’ve listed below common marketing channels I’ve seen startups find success with, and that you can use to build a cohesive multichannel marketing strategy with. My fellow healthtech nerd Chris Turitzin also has a helpful post breaking down ones he’s seen work (and not):

Digital channels

Generally the most cost-effective and can be the most targeted given the rich data behind our digital footprints. As discussed, the consideration is that these channels have gotten increasingly saturated, higher cost, and scrunitized for privacy concerns. These channels may be good for white-collar employers and commercial health plans with members of younger demographics, who are active online, and with high connectivity:

- Organic search (SEO). Search Engine Optimization works especially well if your program’s specialty involves patients doing a lot of personal and private research; for example, stigmatized topics like weight management or abortion care. It takes time for your SEO strategy to bear fruit (3 to 6 months) and requires building out a high-quality content marketing machine: long-form articles, FAQs, landing pages for all your ICPs.

- Paid socials. Paid socials allow you to reach a wider audience through Facebook, Instagram, YouTube, and TikTok. Content strategies that I’ve seen work have included creative video-based campaigns, influencer partnerships, and spotlighting authentic founder stories. Given the growing complexities of digital ads with pixel tracking and the saturation of these channels, they tend to be more complex and less cost-effective than 5 years ago.

- Emails. Email marketing is a default channel you should always have on, especially for employers. It often takes 3 to 4 touchpoints for someone to engage, so set up automated campaigns. Email is less reliable for members on public insurance, given 50%+ of Medicare and 60%+ of Medicaid members’ emails that health plans have are wrong.

Traditional channels

Higher touch, broader, and local marketing channels compared to digitally native ones. Think of it as the inbetweener, before you invest in community-based channels that are hyperlocal. The considerations are that it’s harder to subsegment audiences, difficult to measure and track, and tends to be more expensive than digital channels. These channels may be good for grey-collar employers or Medicare members who represent older demographics or those who don’t spend as much time on digital devices:

- Billboards. I’ve seen startups find success here with regional health plans or employers with a physical location.

- Provider referrals. Investing in a provider referral program can be extremely effective channels given their trust and credibility with patients. It can be difficult to educate busy providers on why and how to refer patients into your program. Help providers understand “What’s in it for me?” which can be access to in-demand specialists that they lack in-house, or even be financial incentives.

- Direct mail. While more expensive than emails, mailers can work well for employers and health plans in building brand credibility and consideration. You can have quick call-to-actions and QR codes for members to learn more; and print on glossy stock paper to provide a bespoke feel amongst the mailbox clutter.

Community-based channels

Highest-touch, hyperlocal channels where you go “boots on the ground” into communities. These channels are capital and operationally intensive, but are often the only ways to reach underserved communities with health-related social needs who don’t proactively seek out health services. These channels are good for low-income Medicaid, rural and low-connectivity members:

- Partnerships with CBOs. I’ve seen effective partnerships to bring programs on-site with churches, soup kitchens and other community-based organizations; and more recently, with barberships, laundromats, and affordable housing developers. For the CBOs, they’re interested in better engagement and outcomes for their members, while driving differentiation to attract new members and funding.

- Community events. Community-based events can create a special, trust-building environment. For example, MCOs have organized and marketed community baby showers, as an activation point to connect expecting mothers to health and social resources. For employers, you can do lunch and learns and tabling at benefits fairs on-site.

- Door-to-door. This tends to be extremely labor and cost intensive. If you’re doing this, recruit community members to do the outreach as they’re already embedded and trusted faces in the community.

Lastly, I wanted to give a special shoutout to the trusty telephone. I believe every startup should have a call center strategy that handles outbound (and inbound) calls. Phones are ubiquitous amongst members. States like Georgia even give every Medicaid member a free phone when they enroll! Make sure to to nail your “pitch” to differentiate from telemarketers; especially as you risk seeing high dropout from funnel as people ask to be placed on DNC lists.

Piecing together a scalable tech stack

The last ingredient is your “enrollment marketing stack,” the internal and external software tools that power your enrollment marketing function. A best-in-class stack allows for a unified data view of the member end-to-end, to measure and track performance, and to constantly iterate on your marketing strategy and intake process. An example on intake process: demographics that may be less tech savvy like Medicare members can face challenges adopting online intake surveys, so collect the bare minimum info of full name and phone number during registration to minimize drop off, and follow up via telephone.

You will likely need to piece together four categories of tools, selecting for ones that can sign BAAs:

- Sales tools like Salesforce Sales Cloud (CRM)

- Digital marketing tools like Iterable (cross-channel marketing), Salesforce Marketing Cloud (CRM), Twilio (comms), Facebook Ads (ads), bit.ly (link management), Jotform (intake surveys)

- Data tools like Snowflake (warehousing), Segment (CDP), Looker (visualization)

- Clinical tools like Epic (EHR) to push the enrolled member into

There’s a lot of pain here. These tools all have to be stitched together and, eventually as your startup scales, you’ll often build home-grown platforms on top to manage automations, modeling and A/B testing. I’ve started to see a few vendors positioning themselves as the all-in-one healthcare marketing platform, although never tried them out myself.

TL;DR, there is no silver bullet

TL DR; There is no silver bullet to acquiring patients for a B2B2C healthcare startup. A comprehensive multi-channel enrollment marketing strategy looks different for every business based on a myriad of factors like their population, condition, and care model. And enrollment marketers are the overlooked heroes within startups leading the charge of driving revenue and (hopefully) outcomes with every patient they acquire.

I’m a big believer of democratizing knowledge in support of builders. If you’re an enrollment marketer, growth lead, or anyone with hard-won lessons, tips and insights to share for other B2B2C healthtech companies, I’d love to add to this living article. Message me on Linkedin or Twitter.

A big thank you to Roger Chen, Pratik Thakkar and Chris Turitzin for contributing your wisdom, edits and ideas.